Buying a home this spring? You’re probably navigating today’s affordability challenges and dealing with the limited number of homes for sale. But, what if there was a solution that could help with both?

If you’re having a hard time finding a home you love, and mortgage rates are putting pressure on your budget, it may be time to look at newly built homes. Here’s why.

New Home Construction Is an Inventory Bright Spot

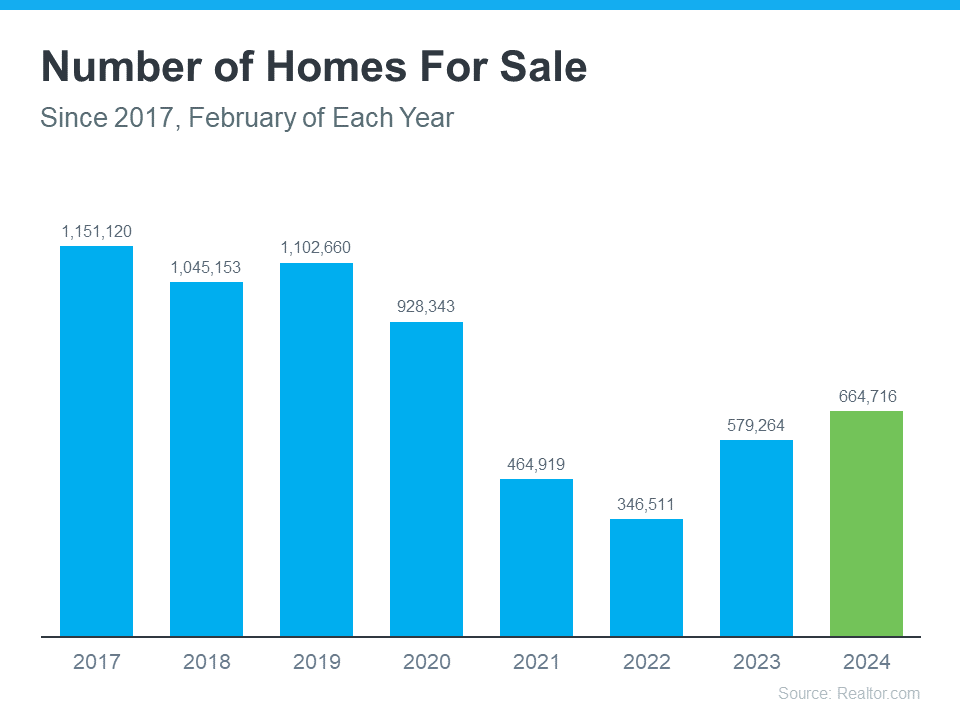

When looking for a home, you can choose between existing homes (those that are already built and previously owned) and newly constructed ones. While the number of existing homes for sale has increased this year, there are still fewer available than there were in more typical years in the housing market, like back in 2018 or 2019.

So, if you’re looking to expand your pool of options even more, turning to newly built homes can help. As Danielle Hale, Chief Economist at Realtor.com, explains:

“The shortage of existing homes For Sale has opened up the possibility of new-home construction to more buyers who may not have once considered it.”

And the good news is, there are more newly built homes to pick from right now. The graphs below use data from the Census to show how new home construction is ramping up in two key areas (see most recent spike in green):

Starts, or homes where builders just broke ground, have seen a big increase lately. And completions, homes that builders just finished, are also up significantly. So, if you want a new, move-in ready home or you want to get in early and customize your build along the way, you have more options right now.

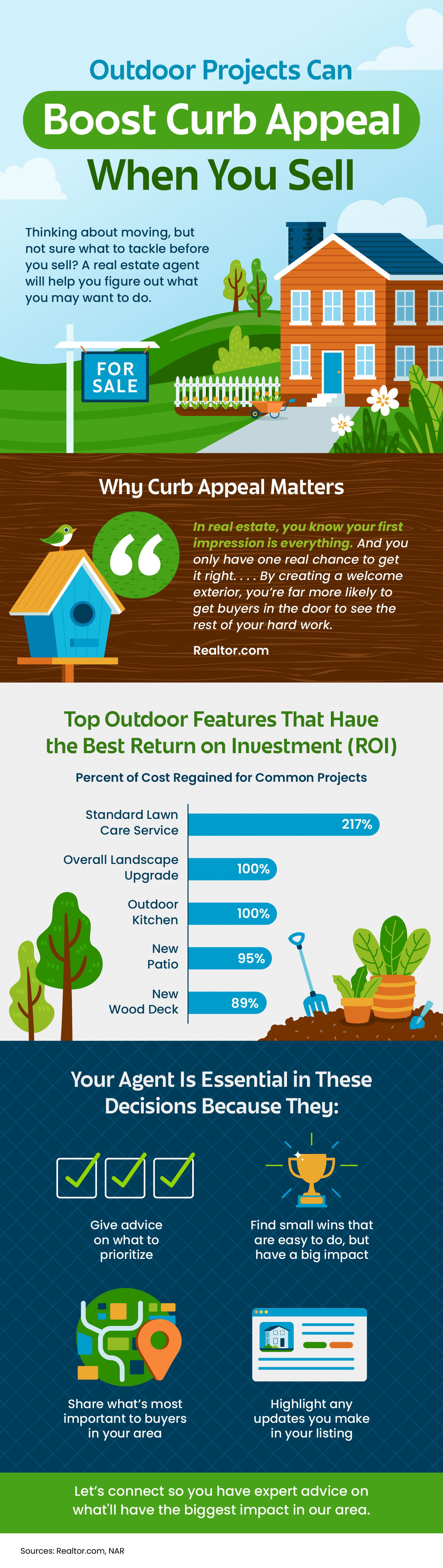

Builders Are Offering Incentives To Help with Affordability

And to sweeten the pot, builders are offering things like mortgage rate buy-downs and other perks for homebuyers right now. This can help offset today’s affordability challenges while also getting you into your dream home. Mark Fleming, Chief Economist at First American, explains why you may find builders have more wiggle room to offer more for you than the typical homeowner:

“Builders aren’t rate locked-in. They would love to sell you the home because they’re not living in it. It costs money not to sell the home. And many of the public home builders have said in their earnings calls that they are not going to be pulling back on incentives, especially the mortgage rate buydown, so that will help the new-home market continue to perform well in the spring home-buying season.”

An article from HousingWire also says this about what builders are offering right now:

“. . . the use of sales incentives still shows some momentum as 60% of respondents reported using them, up from 58% in February. “

Just remember, buying from a builder is different from buying from a home seller, so it’s important to partner with a local real estate agent. Builder contracts can be complex. A trusted agent will be your advocate throughout the process.

They’ll be your go-to resource for advice on construction quality and builder reputation, reviewing and negotiating contracts to get you the best deal, helping you decide on which customizations and upgrades are most worthwhile, and a whole lot more.

Bottom Line

If you’re struggling to find a home to buy, or with today’s affordability challenges, let’s connect to see if newly built homes could be the solution you’re looking for.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link